Event Survey Practical Points

If you’re looking to create a survey used for capturing customer feedback about completed events of transactions, here are some practical points.

Keep It Short. If you want to get a good response rate, then keep it short and sweet — the ol’ KISS logic. For most transactional processes, 7 to 12 questions should be sufficient. You MUST resist the temptation to turn into an “all things for all people” survey — or more appropriately, “all things for all departments” survey. Every department will want a piece of your action. Say “NO” early and often. It’s either naiveté or sheer arrogance on the part of the survey designers to believe that they can get — or con — a respondent into taking a long survey and generate legitimate answers.

Use Random Sampling. If you have ongoing transactions with a customer base, you probably don’t want to send a survey invitation to everyone every time they have had a closed transaction. This will promote “survey burnout” and lead people to completing the survey only when they have an axe to grind — the so-called self-selection, non-response bias. Instead, randomly select people from the list of closed transactions. You will need some administrative controls over this list management to ensure you don’t overly survey certain people.

In the Home Depot case, random sampling really isn’t in play since this is an event survey with a point-of-contact survey administration method. They could generate the survey invitation randomly on the receipts, but survey burnout isn’t caused by repeated invitations but by the survey length.

Implement a Service Recovery (Complaint Handling) System Concurrent with the Event Survey Program. Complaint handling and event surveying are tightly linked. They’re complementary elements in a customer retention program. If a customer voices a complaint in a survey and you don’t respond, how’s the customer going to react? Obviously, you’ve just flamed the fires of dissatisfaction. A Yahoo web page has the following comments about the Home Depot survey:

Towards the end it asks for comments. I gave some comments then asked if anyone actually reads these comments. I gave my email address, and asked for a reply, but no one ever replied. I figured I’d at least get a form reply. Do you think anyone actually reads the comments in surveys like these?

Towards the end it asks for comments. I gave some comments then asked if anyone actually reads these comments. I gave my email address, and asked for a reply, but no one ever replied. I figured I’d at least get a form reply. Do you think anyone actually reads the comments in surveys like these?

[reply to the post] I did the same thing when I took the survey. I had a lot of bad comments and asked for a reply. No response. I will go to my local hardware store next time. It just seems like HD has gotten too big, almost like Walmart. (sic)

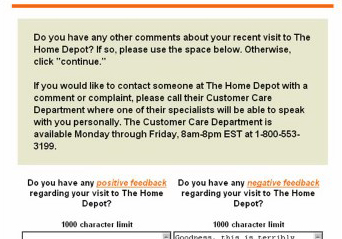

The comment screen on the Home Depot survey does say that if you have issues you would like addressed to call its Customer Care Department, providing the toll-free number. But do customers recognize — or care — that the survey program is not linked to the customer service operation? Of course not. Try explaining to a customer why entering a comment like the ones above is not equivalent to contacting customer service. You’ll get glazed looks back. This practice demonstrates inward-out thinking, not outward-in thinking. (And if we’re on Daylight Savings Time, exactly what are the hours for Customer Care?)

Consider Different Survey Administrative Methods. Transactional surveying can be done by telephone, web form, paper sent through postal mail, or using the IVR if you’re in a call center operation. Since this is a quality control tool, you want to get your data as quickly as possible to act on any business process issues. Postal mail surveys are notoriously slow. Telephone surveys are expensive. Web form surveys are fast and inexpensive once the system is set up, but your target audience must have web access and be web savvy. Could Home Depot be introducing an administrative bias through web surveying?

How Often & How Soon to Survey. In the Home Depot point-of-contact survey approach, the surveying is essentially done at the close of a transaction. In situations where you have a data base of customer contact information, you could do the surveying in batch mode, say, every day or every week. Weekly is the typical period. If you let the period be too long, say monthly, the respondents’ recall will be poor, and you increase the probability of a process problem affecting yet more customers until you learn about the problem through your survey.

Outsource Surveys Versus In-House Execution. Many surveying services exist that will conduct the survey program for you. They may give you real-time access to the results through a web portal, and they may give you comparative statistics with other companies in your industry. But you will pay for these features. Transactional surveys can readily be done in house, but don’t short change the design and set-up. You need to have some level of dedicated focus in a program office to make it happen. You also must protect the confidentiality of any survey information about employee performance.

Pilot Test Your Surveys. A survey is a product that you as the survey designer should test before launching, just as a company should test any product before making it and selling it to customers. The pilot test or field test is critical to finding out the flaws in the detail of the survey design and in the overall design, like its length. If the Home Depot survey was pilot tested, it was an ineffectual test.

Don’t Abuse The Survey and Your Respondents. Please know the difference between an event survey and a relationship survey, and be humble in your request for your respondents’ time. By attempting to make the survey serve two masters — the event and the relationship — you’ll compromise on both. By shooting for the stars in terms of the information you demand, you may just get nothing. Or worse than nothing — made-up responses just to get to the raffle.