Unemployment Compensation Data Collection Form Ambiguities

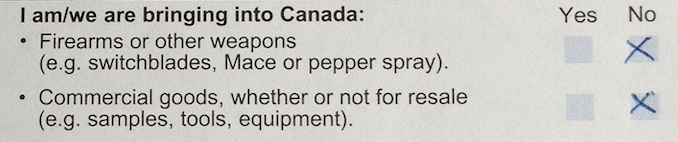

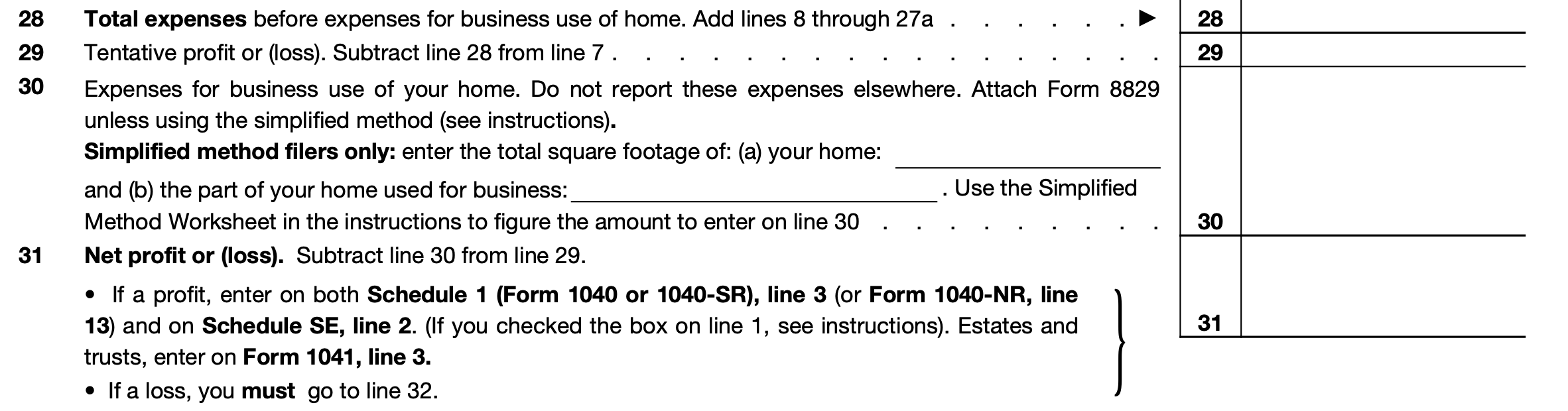

I recently encountered some wonderfully bad examples when applying for unemployment as a result of the Covid pandemic, even as a self-employed person. The form contained a series of Yes/No question. Look at the nearby screenshot of one of them.

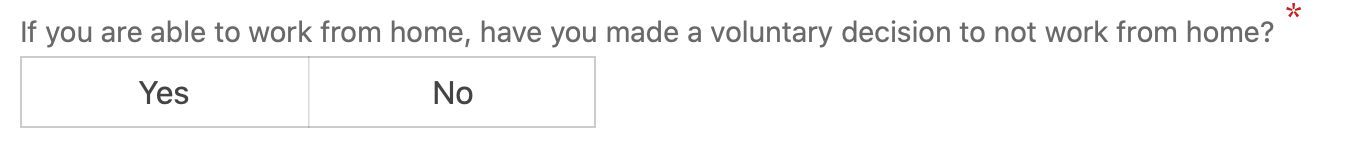

Mass PUA Conditional Question

The question opens with a dependent clause (adverbial clause in this case). How would you answer this if you were NOT able to work from home, for example, a self-employed electrician? The Yes/No applies to the “voluntary decision”. You can’t just skip the question since it’s required.

This question begs for the dependent clause to be set up as a branching question.

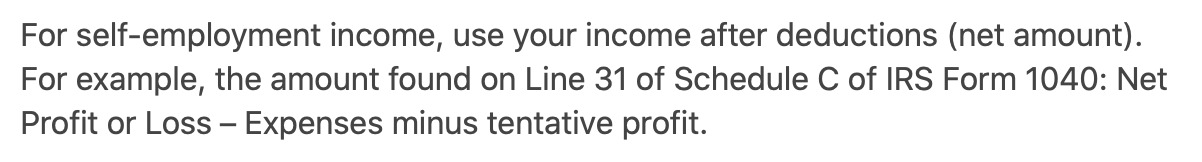

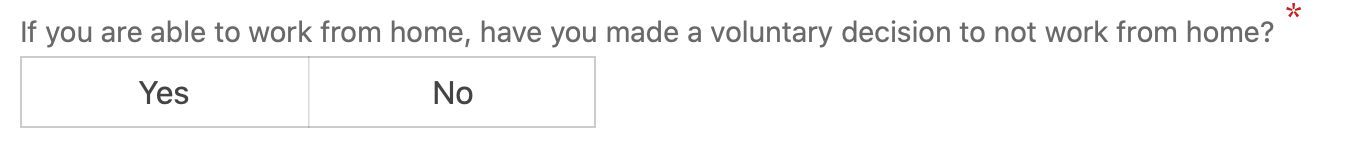

Later, the form has truly bizarre phrasing that could only be written by someone, including the proof readers – if any — who have no concept of basic accounting. The state wants to know your income so it can determine benefits. Nearby is the question for this.

What is “Expenses minus tentative profit”?

First of all, “Income” is an ambiguous term. Yup. People who work for a company think of income as what’s in their weekly paycheck. For the self-employed, we have to get stricter with our terms. Companies generate revenue. Expenses are subtracted from revenue to arrive at income. (I’m keeping this simple; it’s actually more complicated.)

While I “deduct” expenses from my revenue, those aren’t “deductions” in the sense we use on tax forms.

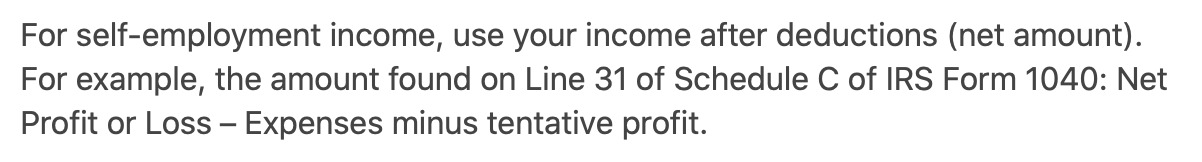

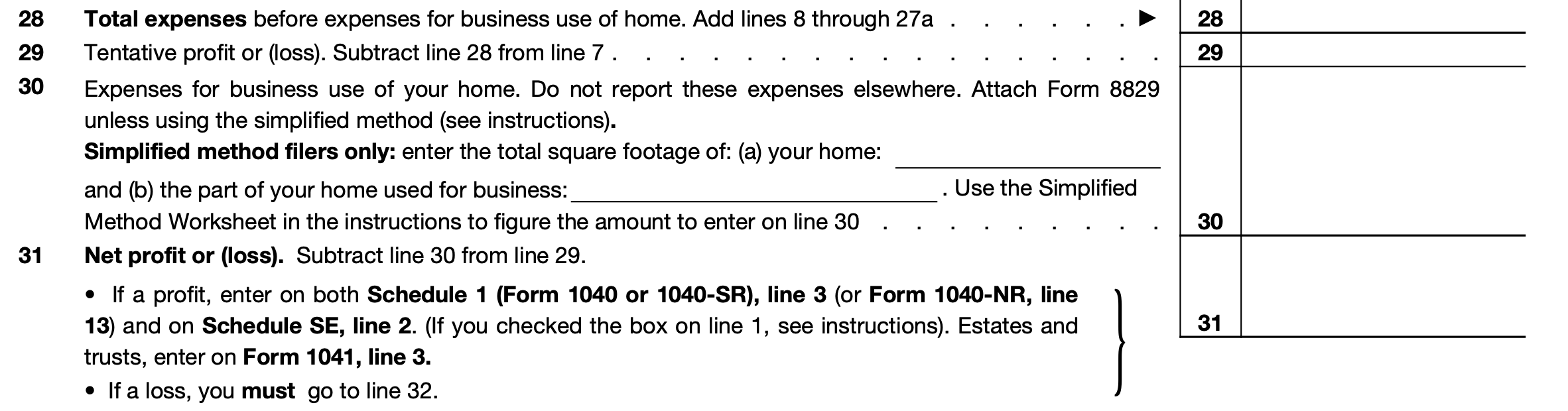

But they help us out by pointing to the line on the tax form with the answer (Line 31 of Schedule C), right? Well, nearby is a screenshot from Schedule C.

Schedule C Net Profit Form

Line 31 is correct. That’s what they want us to report. I think. But the question throws in “Net Profit or Loss – Expenses minus tentative profit.”

I’ve been self-employed for 25 years. I have a masters and doctorate in business. I’ve taught in business schools for 30 years. I have no idea what “Expenses minus tentative profit” means. And neither does the person who wrote the question.

Line 31 is Tentative Profit minus Expenses. Yup, they got it backwards.

The question as worded stopped me in my tracks. I literally looked up Schedule C. I didn’t want to answer incorrectly since I’d be breaking the law. But the real crime is the incorrect question phrasing.

Yes, I understand this was all thrown together in a rush, but couldn’t someone have read it over? Hey, Commonwealth of Massachusetts; I’m up for hire!